Now that we have closed the temporary accounts, let’s review what the post-closing ledger (T-accounts) looks like for Printing Plus. Closing entries are posted in the general ledger by transferring all revenue and expense account balances to the income summary account. Then, transfer the balance of the income summary account to the retained earnings account. Finally, transfer any dividends to the retained earnings account.

Step 3: Clear the balance in the income summary account to retained earnings

The balance in Income Summary is the same figure as whatis reported on Printing Plus’s Income Statement. After closing both income and revenue accounts, the income summary account is also closed. All generated revenue of a period is transferred to retained earnings so that it is stored there starting a bookkeeping business for business use whenever needed. All revenue accounts are first transferred to the income summary. Here you will focus on debiting all of your business’s revenue accounts. Notice that the balances in the expense accounts are now zero and are ready to accumulate expenses in the next period.

How to post closing entries?

Closing entries are journal entries made at the end of an accounting period, that transfer temporary account balances into a permanent account. Since dividend and withdrawal accounts are not income statement accounts, they do not typically use the income summary account. These accounts are closed directly to retained earnings by recording a credit to the dividend account and a debit to retained earnings. The purpose of closing entries is to prepare the temporary accounts for the next accounting period. In other words, the income and expense accounts are “restarted”. Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period.

How to close revenue accounts?

This crucial step ensures that financial records are accurate and up-to-date for the next period, making it easier to track the company’s performance over time. These entries are made to update retained earnings to reflect the results of operations and to eliminate the balances in the revenue and expense accounts, enabling them to be used again in a subsequent period. Failing to make a closing entry, or avoiding the closing process altogether, can cause a misreporting of the current period’s retained earnings. It can also create errors and financial mistakes in both the current and upcoming financial reports, of the next accounting period. The purpose of the income summary is to show the net income (revenue less expenses) of the business in more detail before it becomes part of the retained earnings account balance. Closing all temporary accounts to the income summary account leaves an audit trail for accountants to follow.

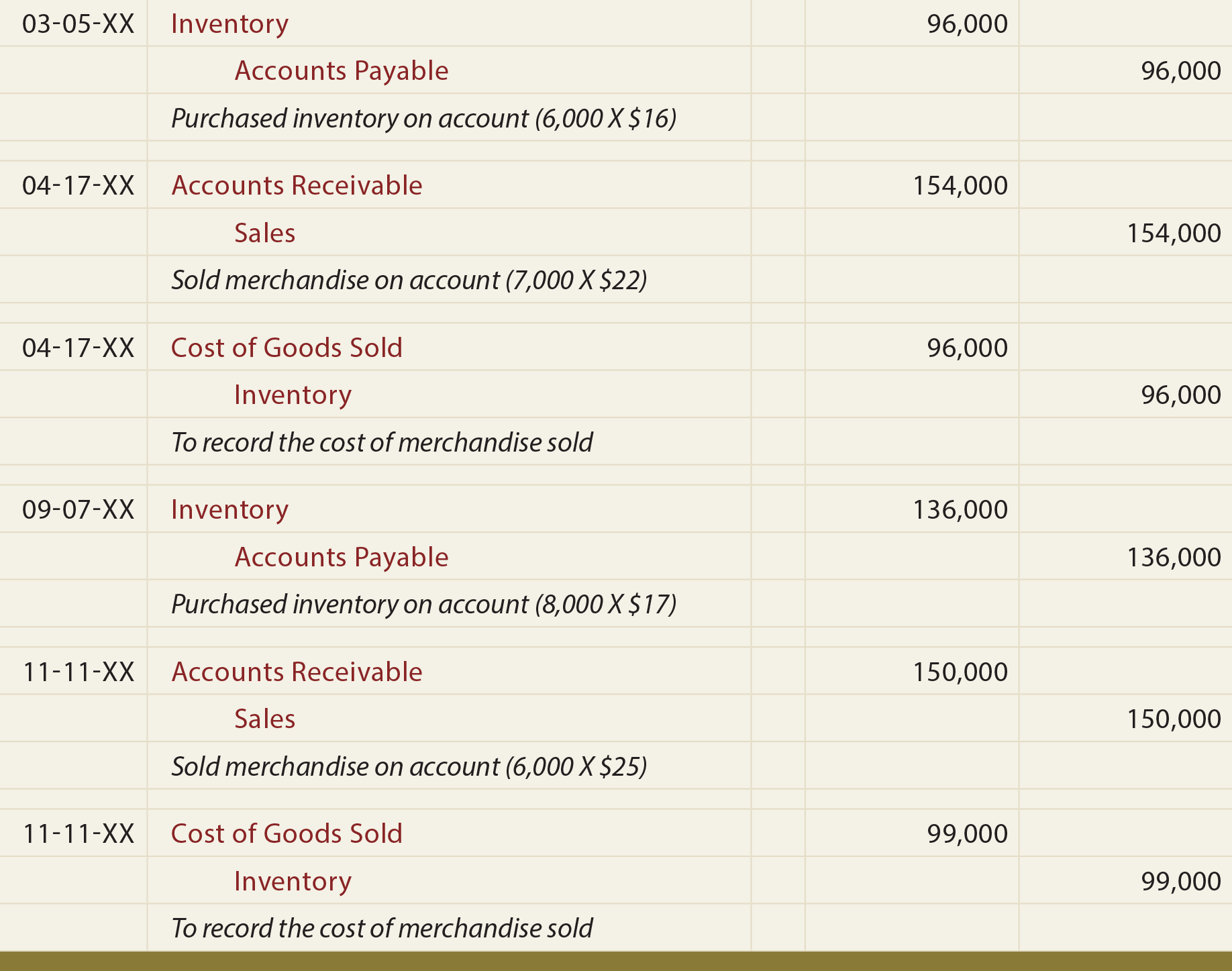

It can be a calendar year for one business while another business might use a fiscal quarter. Dividend account is credited to record the closing entry for dividends. The $9,000 of expenses generated through the accounting period will be shifted from the income summary to the expense account. The $10,000 of revenue generated through the accounting period will be shifted to the income summary account. In this example, the business will have made $10,000 in revenue over the accounting period.

- This is done through a journal entry that debits revenue accounts and credits the income summary.

- Closing entries are performed after adjusting entries in the accounting cycle.

- You have also not incurred any expenses yet for rent, electricity, cable, internet, gas or food.

- We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

- Closing entries are crucial for maintaining accurate financial records.

- The closing journal entries example comprises of opening and closing balances.

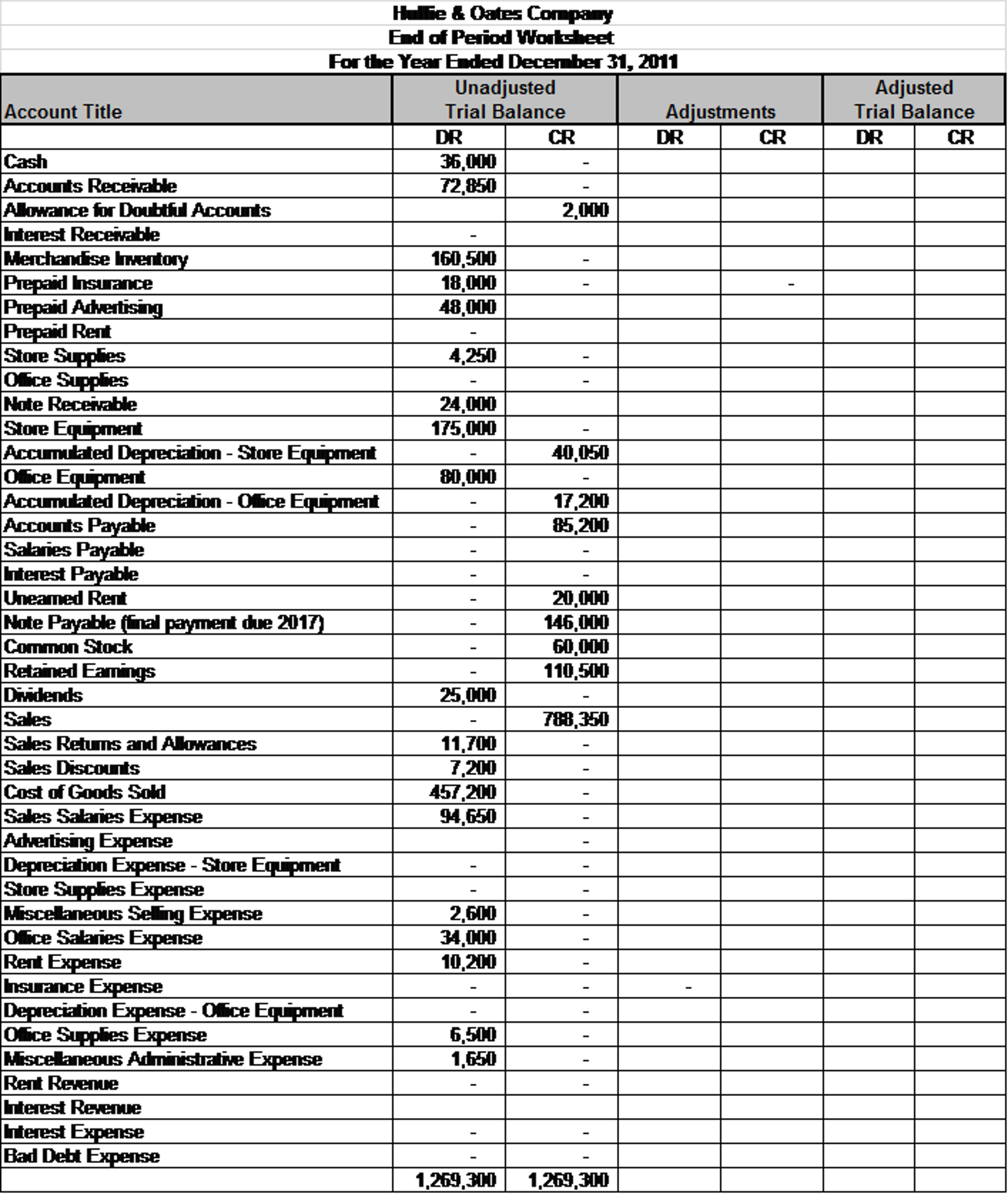

If both summarizeyour income in the same period, then they must be equal. Thebusiness has been operating for several years but does not have theresources for accounting software. This means you are preparing allsteps in the accounting cycle by hand. Any remaining balances will now be transferred and a post-closing trial balance will be reviewed.

He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

Take note that closing entries are prepared only for temporary accounts. Notice that the balances in interest revenue and service revenueare now zero and are ready to accumulate revenues in the nextperiod. The Income Summary account has a credit balance of $10,240(the revenue sum). Understanding the accounting cycle and preparing trial balancesis a practice valued internationally. The Philippines Center forEntrepreneurship and the government of the Philippines hold regularseminars going over this cycle with small business owners.

Temporary accounts can be found in the accounting ledger, specifically the general ledger of accounts. This ledger is used to record all transactions over the specific accounting period in question. This list of general ledger accounts with their balances is known as the trial balance. Total revenue of a firm at the end of an accounting period is transferred to the income summary account to ensure that the revenue account begins with zero balance in the following accounting period. The income summary account is an intermediary between revenues and expenses, and the Retained Earnings account.