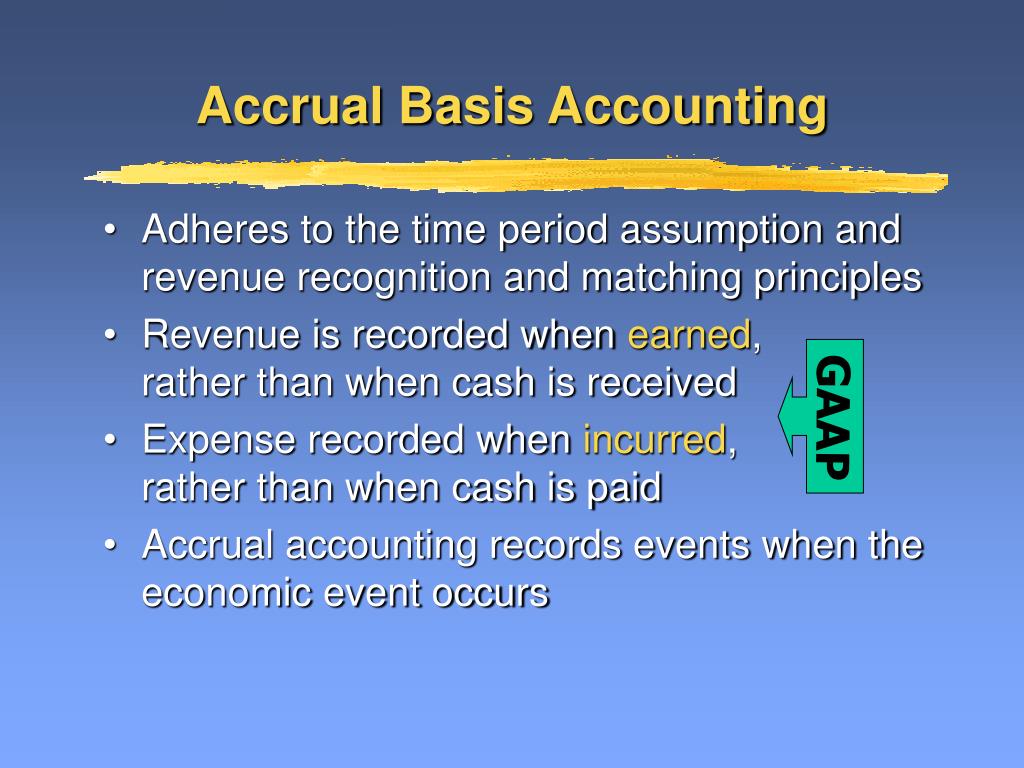

Instead, it must spread the revenue over the life of the contract, matching it with the period in which the services are rendered. This approach prevents the overstatement of revenue in one period and ensures a more balanced financial representation. The accrual method of accounting is based on the matching principle, which states that all revenue and expenses must be reported in the same period and “matched” to determine profits and losses for the period. Accrual accounting provides an up to date overview of an organization’s assets and liabilities as it records accrued revenue, accrued expenses, deferred revenue and deferred expense. Smaller nonprofits may decide on the cash basis accounting method because it’s simpler, and they will likely have limited funding to pay for an accountant to take care of the work required with accrual accounting.

Accrual Accounting vs Cash Accounting : Key Differences

The 2023 financial statements must reflect the bonus expenses earned by employees in 2023 as well as the bonus liability the company plans to pay out. An adjusting journal entry therefore records this accrual with a debit to an expense account and a credit to a liability account before issuing the 2023 financial statements. Unlike the cash method, the accrual method records revenue when a product or service is delivered to a customer with the expectation that money will be paid in the future. Likewise, expenses for goods and services are recorded before any cash is paid out for them. Expense recognition is a pivotal element of accrual accounting, ensuring that costs are recorded in the period they are incurred, aligning with the revenues they help generate.

What Is Accrual Accounting, and How Does It Work?

To learn more about cash and accrual accounting and how each may help your small business grow, please see the following frequently asked questions. It takes a lot of time and energy to maintain years’ worth of financial documents, checking and updating them as needed. This is why as businesses grow, they hire a part-time or full-time accountant to handle the important bookkeeping and accounting duties of the company.

What Are Some Critiques of Accounting Principles?

Whether you use accrual accounting or the cash basis method, FreshBooks’ secure and simple accounting software makes it easier for small businesses to create helpful balance sheets and keep their finances on track. Deferred revenue is the term used when your business has received payment for a good or service you haven’t yet provided to them. For example, if your customer has paid for a magazine subscription from your company, but the first issue doesn’t come out for two months, the money is considered deferred revenue.

- Prepaid expenses, such as insurance or rent paid in advance, are initially recorded as assets.

- The accrual and cash basis of accounting can both be used side-by-side as both systems have their own relevance and applicability.

- We may earn a commission when you click on a link or make a purchase through the links on our site.

- In the United States, generally accepted accounting principles (GAAP) are regulated by the Financial Accounting Standards Board (FASB).

Earnings, on the other hand, are those transactions that lead to a gross increase in owners’ equity on account of goods transferred or services rendered to customers. Still, it’s important to review the IRS guidelines on how to report an advance payment for services using the accrual accounting method. This means you add income to your accounting journal when you complete a service or deliver goods and expenses when you receive an invoice for the goods and services. ninja loan financial definition of ninja loan The ultimate goal of any set of accounting principles is to ensure that a company’s financial statements are complete, consistent, and comparable. Explore the principles of accrual accounting, its differences from cash basis, and its impact on financial reporting and decision-making. For example, imagine a dental office buys a year-long magazine subscription for $144 ($12 per month) so patients have something to read while they wait for appointments.

Comparability is the ability for financial statement users to review multiple companies’ financials side by side with the guarantee that accounting principles have been followed to the same set of standards. Notice that in case “B”, John has paid $80,000 cash but has recorded a $100,000 expense during the period because the annual rent of the building is $100,000, not $80,000. The remaining $20,000 is a current liability, known as rent payable, which will be settled in a subsequent period. Also notice that in case “C” John has paid $150,000 cash but has again recorded only $100,000 as rent expense. The balance of $50,000 is a current asset known as prepaid rent, which can be adjusted against the rent of a subsequent period.

For example, consider a consulting company that provides a $5,000 service to a client on Oct. 30. The client received the bill for services rendered and made a cash payment on Nov. 25. Under the cash basis method, the consultant would record an owed amount of $5,000 by the client on Oct. 30, and enter $5,000 in revenue when it is paid on Nov. 25 and record it as paid. In other words, the revenue earned and expenses incurred are entered into the company’s journal regardless of when money exchanges hands. Accrual accounting is usually compared to cash basis of accounting, which records revenue when the goods and services are actually paid for.

Other, more complicated transactions involve buying and selling on credit, which requires a company to account for monies that they will have to pay or receive at a future date. Recognizes revenue and expenses when they are earned or incurred, irrespective of whether an actual cash transaction has occurred. Deferrals, on the other hand, are when an organization has received a pre-payment for a service or product that is not yet earned or they have paid for an expense which is yet to be incurred.

All that is necessary is to record the fact that Andrea withdrew funds – with a debit entry in the drawings account and credit entry in the bank account. The business entity principle simply means that, for the purpose of maintaining accounting records, the business is treated as a separate entity from the owner(s) of the business. The Conceptual Framework refers to a ‘reporting entity’ which is an entity that is required, or chooses, to prepare financial statements. Here are a few examples of accrual accounting methods followed within a business for an accurate business process. Has your business reached the point where you’re ready to hire more employees or expand into new customer markets? As your business becomes more complex, it may be time to revisit whether accrual accounting will be more effective for your financial and tax reporting.

The expenses would be recorded as an accrual in December when they were incurred if a company incurs expenses in December for a service that will be received in January. The accruals are made via adjusting journal entries at the end of each accounting period so the reported financial statements can be inclusive of these amounts. However, the cash basis method might overstate the health of a company that is cash-rich.