Through advanced AI algorithms, it can analyze vast amounts of financial data to identify patterns, trends, and anomalies that were once invisible to accounting professionals. This enables businesses to make informed decisions and optimize their financial strategies in a timely manner. These AI tools for accounting offer a wide range of features, such as automating data entry, invoice processing, financial statement preparation, fraud detection, and predictive analysis. By leveraging these tools, businesses can reduce manual errors, increase efficiency, and stay ahead of potential issues before they become a problem. One of Zeni’s key strengths lies in its ability to provide a complete financial solution on a single platform. From bill pay and invoicing to expense management and financial planning, Zeni offers a wide range of services to meet the diverse needs of growing businesses.

How To Choose AI Accounting Software

It provides tools for organizing client information, tracking tasks, and automating workflows, enabling firms to streamline their practice management. Users can easily create and manage expense reports, streamlining the expense management process and providing valuable insights into business costs. About rules and automation, Dext allows users to set up custom rules knowing when you should request a third party evaluation and automation to categorize and process financial data more efficiently.

How can accounting firms leverage AI?

- Rows AI is a modern spreadsheet editor that uses artificial intelligence to analyze, summarize and transform data.

- Indy is a comprehensive productivity platform meticulously designed to cater to the unique needs of freelancers and independent professionals.

- Plus, these bots can sign into accounts, record bank transactions, and make bank reconciliation statements without help.

- Alex McFarland is an AI journalist and writer exploring the latest developments in artificial intelligence.

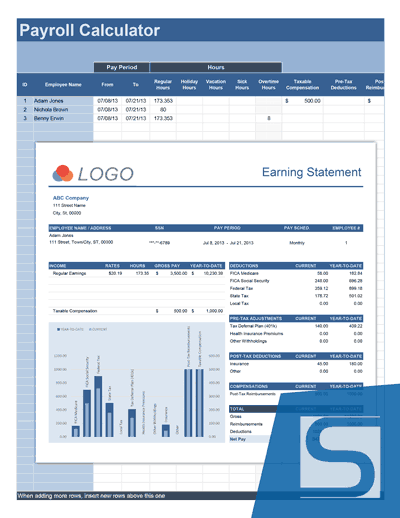

- This comparison chart summarizes pricing details for my top AI accounting software selections to help you find the best software for your budget and business needs.

Indy also integrates with users’ bank accounts, automatically importing transactions and categorizing them for easy reconciliation. Users also gain access to Divvy From Bill, an automated credit and expense management software, at no extra charge. Divvy offers lines of credit up to $15 million and tools to help control budgets and manage spending. AI tools for accounting provide indisputable benefits, from improving financial insights to automating time-consuming tasks. Integrating AI into your accounting firm is not about replacing human beings but rather unleashing their unique capabilities. By letting AI handle routine and repetitive tasks, you can free up your staff to focus on experience-based analysis, strategic decision-making, and client relationships.

AI tools use advanced algorithms to process and analyze financial data instantly. Through this AI analysis, trends, anomalies, and patterns that might go unnoticed by human eyes can be spotted. Also, by learning from the data it processes, the AI system can improve over time and provide fast and accurate financial what is variable costing insights. Bill & Divvy leverages AI to help businesses create and manage budgets more effectively, providing insights into spending patterns and trends. The platform simplifies expense reporting by automatically categorizing transactions and integrating with popular accounting software like QuickBooks, Xero, and NetSuite. Bill & Divvy also uses AI-driven algorithms to detect and prevent potential fraud, ensuring the security of business finances.

Increased Financial Security

The tool evaluates transcript statements based on terms from Lee’s prompt including “CAGR,” “growth strategies,” and “investment strategies,” and then summarizes each company’s outlook. Accounting is all about calculations, mathematics, regulated processes, and tax compliance. The human-AI partnership holds immense promise for efficiency, accuracy, and innovation. However, firms must prioritize ethical considerations to ensure they protect themselves and their clients. This implementation resulted in a remarkable 27% increase in efficiency and streamlined operations.

Overall, these accounting automation tools offer businesses more accuracy and efficiency in managing their finances. With automated compliance and audit readiness, Trullion gives you the tools to meet complex lease accounting standards while improving efficiency. The platform also offers visual dashboards, allowing your team to monitor key metrics and make informed decisions faster. Features include AI-powered bookkeeping, where your team can automate tasks like expense categorization and transaction management.

Booke is an innovative AI-powered bookkeeping automation platform designed to streamline financial processes for businesses and accounting professionals. The platform’s intelligent algorithms excel at extracting data from financial documents in real-time, ensuring that financial records are always up-to-date and precise. One of Gridlex’s standout features is its accounting and ERP module, Gridlex Sky. This component enables businesses to manage their finances effectively, offering capabilities such as invoicing, bill management, and bank reconciliation. By automating financial processes, reducing manual calculations, and simplifying expense claims, Gridlex Sky significantly enhances accounting efficiency.

Xero is suitable for small to mid-sized businesses that need an easy-to-navigate system. Certinia is a cloud-based platform that connects financial management with operational processes to provide real-time insights for decision-making. It is designed for businesses that need to align their financial and operational data, helping teams collaborate and stay informed with integrated workflows and reporting. Finchat.io uses AI and natural language processing to understand and respond to user queries, providing accurate and easy-to-understand answers.

Use Zeni to automate the time-consuming daily expense tracking antique silver bracket wallet with beaded bag and antique and bookkeeping procedures. Learn how Gen AI can help you create new insights, solutions, and opportunities for yourself and your clients. While AI shines in processing large volumes of data, staff members should play a pivotal role in validating AI-generated outputs, cross-referencing information, and verifying the overall reliability of the results.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL (also referred to as “Deloitte Global”) does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the “Deloitte” name in the United States and their respective affiliates.